Business owners are used to tracking sales, costs, and margins.

But, there’s another metric that is hidden in plain sight, that can make or break your business: asset utilization.

Think of it as the percentage of time (or capacity) that an asset is actually being used, compared to the total time it could be. The opposite of this is the idle rate.

Restaurant example

Let’s say you rent a restaurant space. You pay for it 24/7, but you only operate 5 days a week, 8 hours a day.

Hours in a month: ~730

Hours you operate: ~170 hours

Utilization rate = 23%

Idle rate = 77%

That means, you are paying rent for the space to sit empty A LOT.

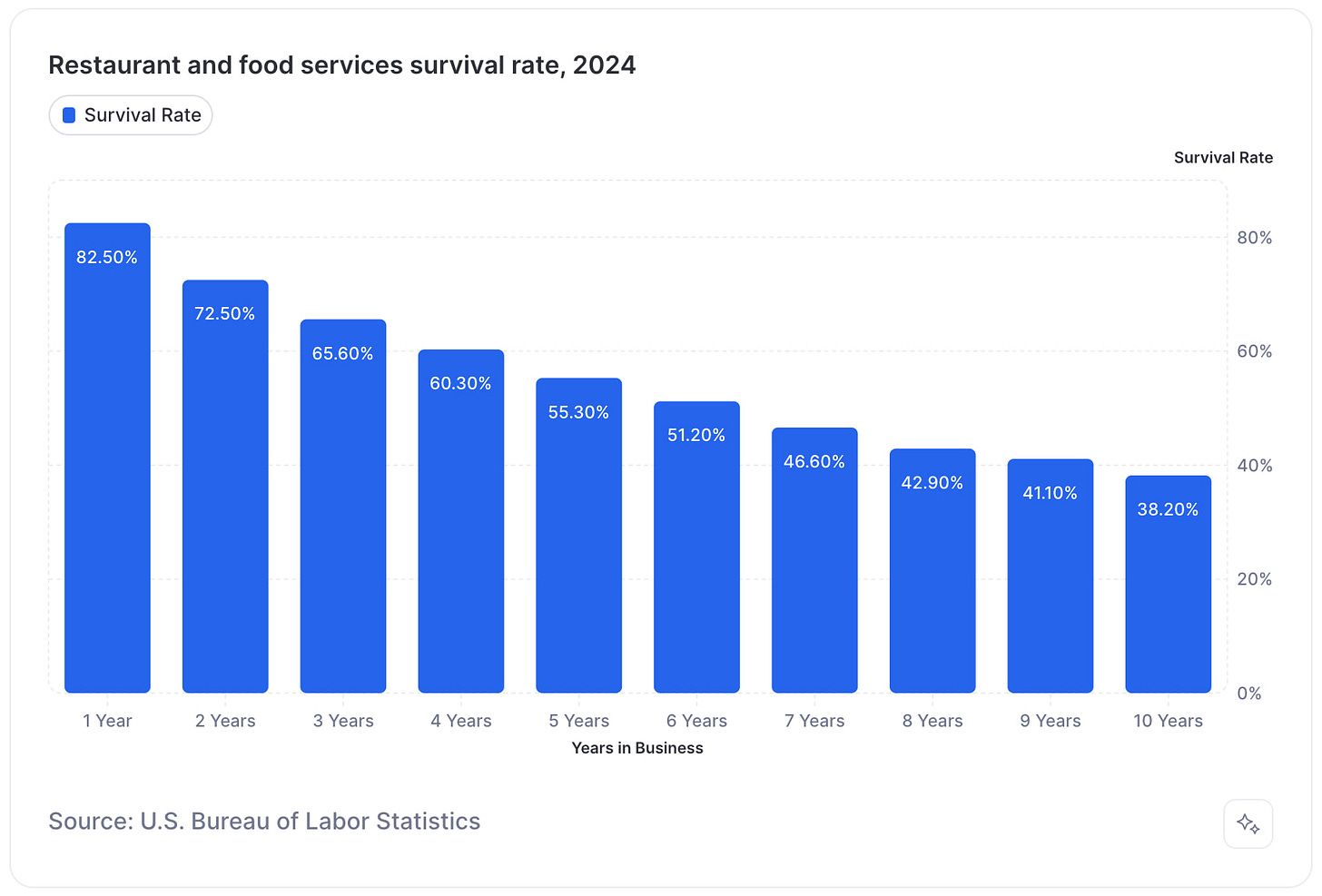

This is one (of the many reasons) why restaurants are tough, low-margin businesses. The fixed cost is there, whether you are serving customers or not.

Restaurant solution

What if three chefs each ran their own restaurant concept in the same space:

Breakfast/brunch

Lunch

Dinner/late night

Suddenly:

The space is used nearly 24/7

Each chef’s rent cost per hour drops

Everyone has a higher chance of making a profit

Bonus: Cooking classes on the weekend. After all, it comes with no extra rent-related costs!

Now, you might wonder, well, I don’t have a restaurant, so this doesn’t apply to me. Idle assets are everywhere.

Gyms are packed between 6 am and 9 am, as well as 5 pm and 8 pm. However, there’s not much going on in the middle of the day, as most of its customers are working.

Solution: Rent the space to yoga instructors, host corporate wellness sessions, or run kids’ fitness programs during off-peak hours.Trucks & delivery vans sit in the parking lot outside delivery times.

Solution: lease them to other businesses looking for their deliveries when you’re not using them.Event venues are booked on weekends but empty during the week.

Solution: Offer discounted weekday rates for corporate workshops or community events.High-end equipment (photography studios, 3D printers) is often used for only a few hours a week.

Solution: Rent to freelancers or other businesses.Office spaces come very close to the first restaurant example in terms of utilization/idle rate.

Solution: List them on coworking or event rental platforms

The list goes on.

The Mindset Shift

It is common for business owners to think of certain costs, like rent or equipment, as fixed. But if you increase its utilization rate, suddenly the cost per hour decreases. So start asking:

What percentage of the time is this asset making me money?

Could someone else use it during the “dead” hours?

Could I repurpose it for another type of customer?

You’re already paying for these assets 24/7.

Instead of cutting costs, sometimes the smarter move is to make what you already have work harder for you.

There is often a great opportunity in squeezing more value out of what you already own.

The impact

Most industry data points put average restaurant rent at ~7% of gross sales.

When staring out, it’ll likely be higher, as it takes time to build relationships with customers. But if it stays at 10% or above, likely there’s no profit.

And here’s the bonus. Sharing a space doesn’t just cut costs - it might allow you to afford a better location, with higher foot traffic, at at same, or lower cost.

Higher utilization, lower risk, bigger upside.

The other side of the equation

You can use this same approach if you’re on the other side. If you're passionate about cooking, starting a restaurant is a significant leap. It requires a significant upfront investment, which might not work well.

But what if you could rent the kitchen of an already existing restaurant for a few hours a day, outside of its business hours? You have the opportunity to give it a try, without making the big jump, while the restaurant gets some compensation for the idle equipment!

If you are stuck, overwhelmed, or need help with brainstorming, reach out to kosta@ristovskiconsulting.com to explore what’s possible..